Neosurf: Drilling for data, digging for gold

13

June, 2025

Neosurf conducted extensive research before launching in the US. Below, Sue Page, CEO Americas, shares what insights the payments company gained into player behaviour and why a data-driven approach is crucial when entering a new market.

When entering a new region, a one-size-fits-all approach simply doesn’t work. A data-driven strategy allows businesses to understand not just high-level trends, but the nuances of each local market – including language, cultural behaviours, preferred payment methods, and platform expectations. This insight is essential for building relevance and trust with new users. It also ensures that product offerings, onboarding flows and communications are tailored in a way that resonates with the specific demographic. Without this foundational understanding, even the most robust technology can fall flat.

Success in payments starts with understanding the user. In the iGaming space, this means knowing how players behave, where they hit friction and how often that friction turns into frustration or churn. For Neosurf, launching in the US was never going to be about offering yet another payment option. It had to be about solving real operator and player pain points – and that meant starting with the data.

Partnering with Betting Hero, Neosurf commissioned in-depth research to explore player payment habits, budgeting behaviour and the gaps in the current experience. The study, which included both surveys and 1:1 interviews, revealed issues that are costing operators more than just customer satisfaction.

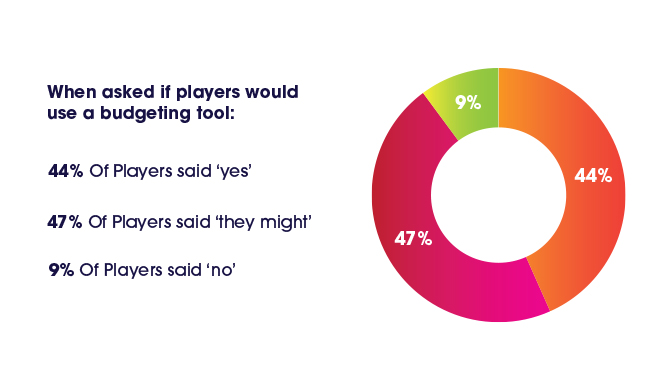

Figure 1: Deposit & withdrawal frequency

Among the standout findings was the sheer frequency of transactions. Over 60% of bettors reported depositing multiple times a month, and over 50% were withdrawing just as often. Specifically, 28% of users deposit weekly and another 27% deposit every other week. Withdrawals followed a similar pattern, with 25% withdrawing weekly and 27% every other week. These frequent money movements – in and out of operator platforms – represent not just user behaviour but significant operational costs. Every withdrawal is a touchpoint, and every touchpoint is a cost. Many operators are seeing funds leave the ecosystem entirely only to return later.

“The inefficiency of this cycle is an industry-wide issue and a drain on margin”

This is where a smarter wallet solution becomes more than a convenience – it becomes a strategic lever. Neosurf saw an opportunity to help operators keep more money in play while still giving players the instant access they expect. By minimising processing fees and creating a frictionless payments experience, the wallet offers a solution for both the players and operators. This approach also appeals to the 66% of respondents who said transaction speed was very important, and the 69% who indicated they would switch to a competitor offering faster withdrawals.

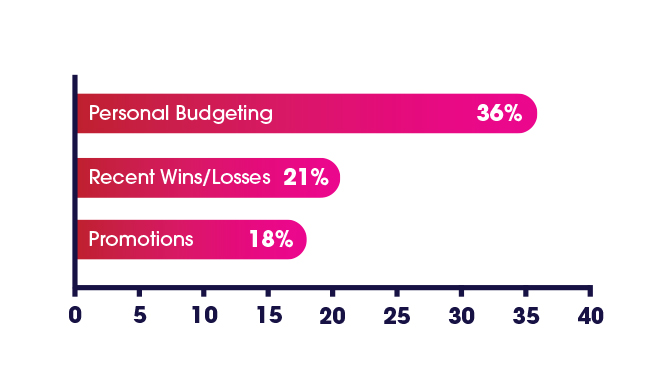

Figure 2: Top deposit motivators

Interestingly, the study also debunked some long-held industry assumptions. While promotions were seen as a key acquisition lever, they came third in the list of deposit motivators. Players are far more influenced by personal budgeting (36%) and recent wins or losses (21%), while only 18% cited promotions. That tells us players want control. They want to feel in charge of their money and are not enticed by short-term incentives or even major sporting events.This insight further validated the development of a unified wallet dashboard – one that helps players manage their sports betting budget and track their spend across all operators, set personal limits and get real visibility into their spending habits.

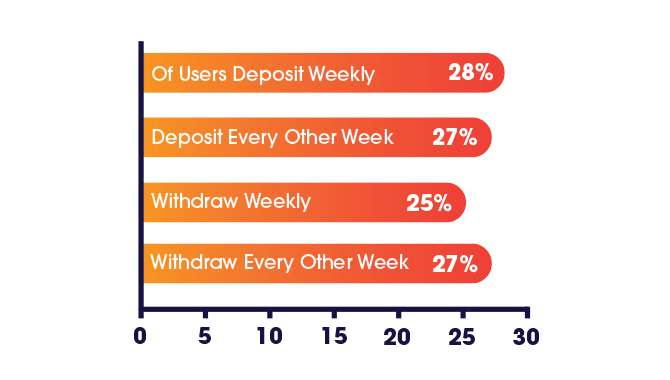

Figure 3: Player willingness to use a budget

Notably, 44% of players said they would definitely use such a tool, and another 47% said they might, depending on the features. So this isn’t about responsible gaming in the traditional, checkbox sense. It’s about smart money management that is embedded naturally into the wagering experience.

And while 73% of players said responsible gaming was important, very few were using the tools currently available to them. Why? Because they didn’t identify with the messaging. In fact, 67% of respondents reported not using any self-limiting or budgeting tools. Many saw RG features as being for “problem gamblers,” not everyday users. By shifting the focus toward budgeting and visibility, Neosurf aims to make these tools feel like a benefit, not a warning.

As Neosurf expands across North America and beyond, this research-first, player-centric model is already informing how products are built and partnerships are formed. It’s also opening a new conversation with operators. At Neosurf we always say “Imagine a payments company that does things a little differently” here we can take that one step further; What if payments weren’t just functional, but strategic? What if the very tools that help players feel more in control also help operators keep more value within their ecosystem?

The answer, increasingly, is found in the data.